Are all cryptocurrencies the same

Cryptocurrencies are digital assets that are secured by cryptography. They use decentralized networks to transfer and store value, and the transactions are recorded in a publicly distributed ledger known as the blockchain https://generoustroopers.com/. Transactions are verified by network nodes and recorded in a public distributed ledger known as the blockchain. Cryptocurrency transactions are secure, and are verified by a decentralized network of computers.

Here at CoinMarketCap, we work very hard to ensure that all the relevant and up-to-date information about cryptocurrencies, coins and tokens can be located in one easily discoverable place. From the very first day, the goal was for the site to be the number one location online for crypto market data, and we work hard to empower our users with our unbiased and accurate information.

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.

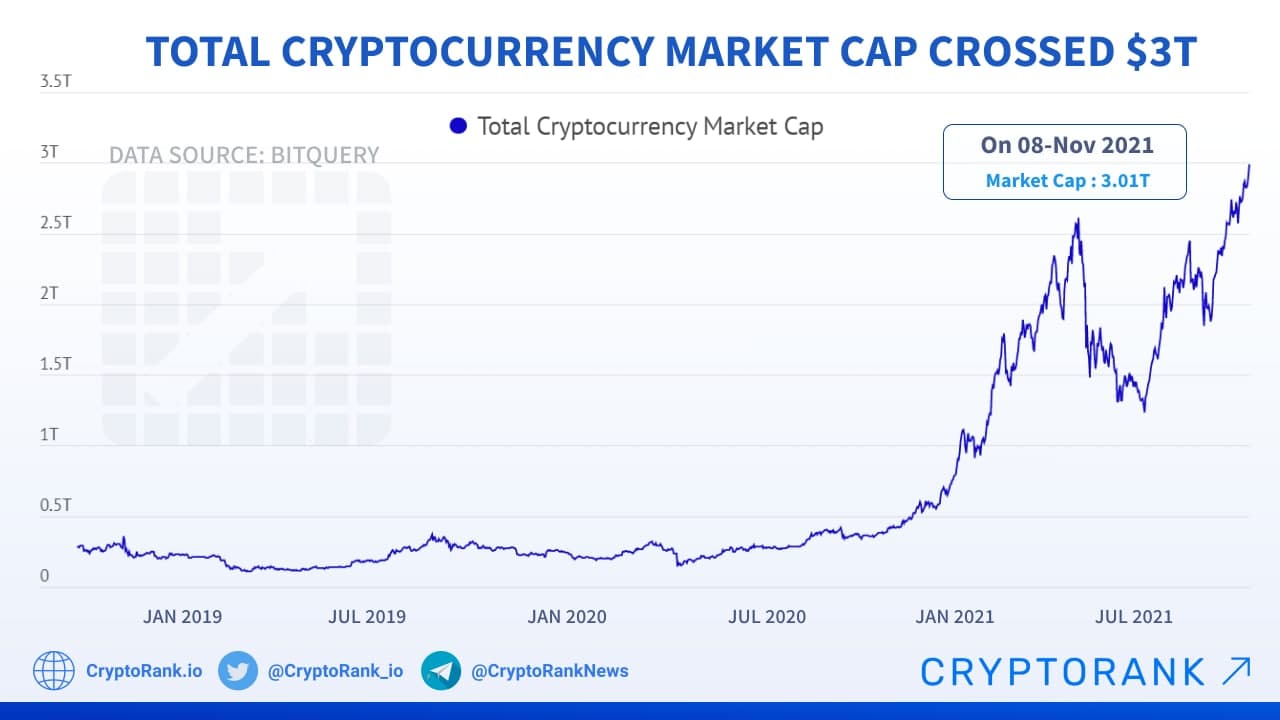

Market cap of all cryptocurrencies

The total crypto market volume over the last 24 hours is $172.65B, which makes a 34.94% increase. The total volume in DeFi is currently $27.22B, 15.77% of the total crypto market 24-hour volume. The volume of all stable coins is now $161.34B, which is 93.45% of the total crypto market 24-hour volume.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

A coin is a cryptocurrency that is the native asset on its own blockchain. These cryptocurrencies are required to pay for transaction fees and basic operations on the blockchain. BTC (Bitcoin) and ETH (Ethereum) are examples of coins.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

Crypto prices are calculated by averaging cryptocurrency exchange rates on different cryptocurrency trading platforms. This way, we can determine an average price that reflects cryptocurrency market conditions as accurately as possible.

Are all cryptocurrencies mined

In cryptocurrency mining, work is performed, and the process ends with new cryptocurrency being created and added to the blockchain ledger. In both cases, miners, after receiving their reward — the mined gold or the newly created cryptocurrency — usually sell it to the public to recoup their operating costs and get their profit, placing the new currency into circulation.

Mining pools allow miners to combine their computational power, increasing the chances of solving a block and receiving a reward. On the other hand, solo mining can be more rewarding if you are successful, but it’s much more difficult to do profitably, especially with popular coins like Bitcoin.

Bitcoin is the first and the most well-known mineable cryptocurrency. Launched in 2009, Bitcoin uses a Proof of Work (PoW) consensus mechanism. Mining Bitcoin requires specialized hardware known as ASICs (Application-Specific Integrated Circuits). These machines are specifically designed for the purpose of mining Bitcoin and are far more efficient than standard CPUs or GPUs.

Only the first individual, group, or business to solve these equations and validate a block of transaction receives what’s called a «block reward.» In the proof-of-work model, as this is known, block rewards are paid out in the cryptocurrency that’s been validated. For instance, if you validated a block of transactions on Ethereum’s network, thereby proving the transactions as true, you would be paid in Ether tokens as a reward. Miners make money by either hanging on to these rewards as an investment and cashing out later, or immediately converting their tokens to a fiat currency, like the U.S. dollar.

The crypto mining system incentivizes security. Miners must successfully and correctly validate transactions, meaning that these individuals safeguard the same cryptocurrency they strive to receive as payment.

The new hash outputs are then organized into pairs and hashed again, and the process is repeated until a single hash is created. This last hash is known as the root hash (or Merkle root) and is basically the hash that represents all the previous hashes used to generate it.