Simple tips to Be eligible for A florida Cellular Mortgage?

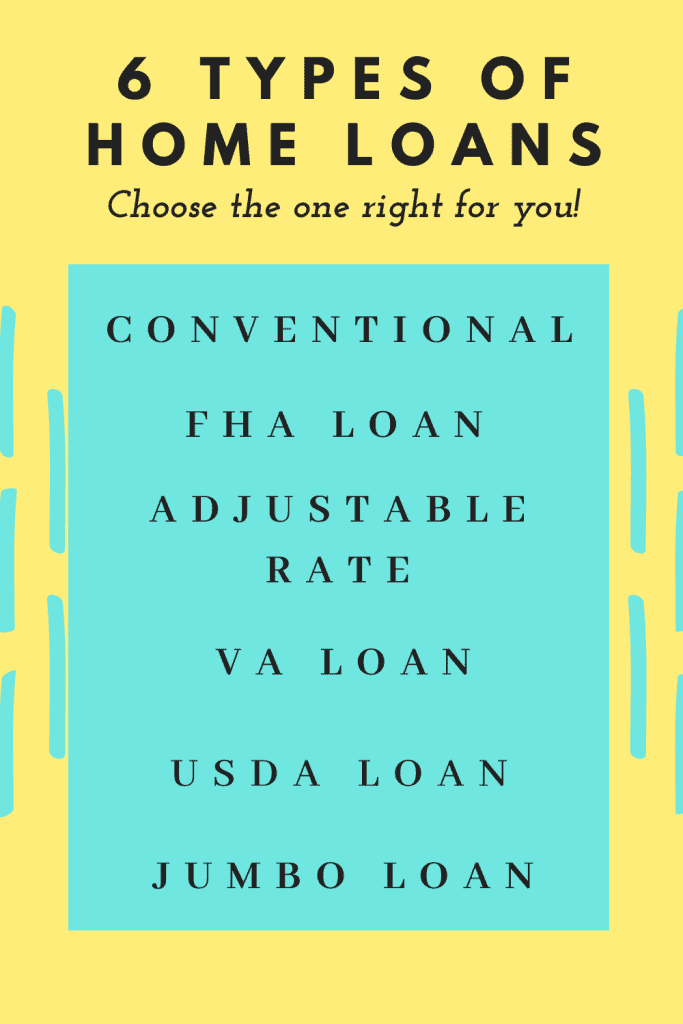

Va Financing

If you want to to get a produced house in addition to package it stands toward, you can seek a Va mortgage, which work much like an FHA Name II loan.

An excellent Va financing possess a great amount of gurus, in addition to zero constraints towards mortgage additionally the option to purchase a home and no put and you will home loan insurance.

Nevertheless were created household need to take a seat on a predetermined basis, complete HUD conditions, and stay gotten for the ground they is onto qualify because of it financing.

USDA Loan

Speaking of supported by new company regarding farming and generally require no down payment, definition you can aquire a loan to invest in 100 % of one’s residence’s value. Nonetheless they come with even more fees, instance a two % make sure commission and you may good 5 % annual payment on top of the month-to-month fees.

The excess charges are used to offset the enhanced exposure owed to your highest LTV. They also have a higher lowest credit score than many other mortgage loans, and you will become turned-down if you make extreme money.

To begin, consult a homes associate to ascertain your budget according to the type of domestic we would like to pick and you can whether or perhaps not you will be applying it their house, rented homes, by coast etc.

Following that, your property agent will highlight home within your budget; it more enhances your chances of taking that loan once you have picked a property.

Your casing professional usually 2nd assist you with the borrowed funds software process. They’re able to assist you in selecting the best home loan to own your position.

Leer másSimple tips to Be eligible for A florida Cellular Mortgage?